John Keells Holdings PLC Doubles EBITDA to Rs.18.3Bn, Signals Even Stronger Second-Half

Summarised below are the key operational and financial highlights of our performance during the quarter under review:

• The Group delivered a strong quarterly performance marked by the contribution from its new investments and businesses as well as a robust contribution across the portfolio. The operationalising of key investments in the first half of the year provides a strong platform to translate to an enhanced profit contribution over the second half and the ensuing financial year.

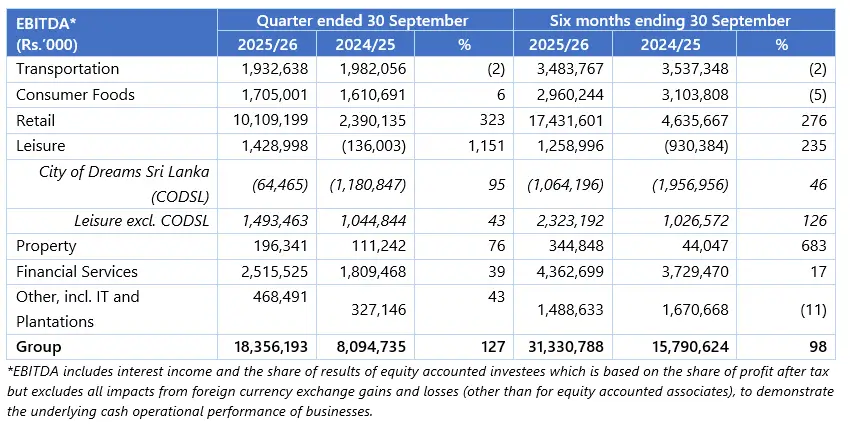

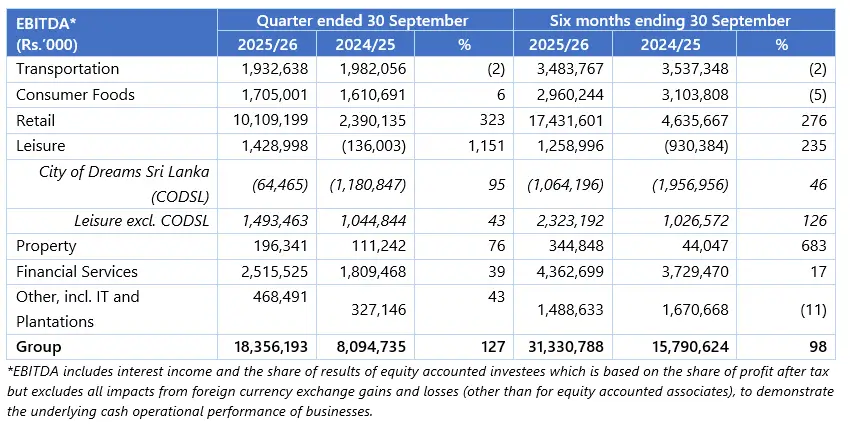

• Group earnings before interest, tax, depreciation and amortisation (EBITDA) at Rs.18.36 billion in the second quarter of the financial year 2025/26 is a significant increase of 127% against Group EBITDA of Rs.8.09 billion recorded in the corresponding period of the previous financial year.

• Cumulative Group EBITDA for the first half of the financial year 2025/26 at Rs.31.33 billion is an increase of 98% against the previous year. Given the high seasonality in many of our businesses, the second half performance is expected to improve further over the first half. The Group recurring EBITDA for the full financial year 2024/25 was Rs. 45.69 billion.

• Group profit before tax (PBT) at Rs.7.80 billion in the quarter under review is a significant increase of 243% against the Rs.2.27 billion recorded in the second quarter of 2024/25.

• Group profit after tax (PAT) at Rs.4.20 billion in the second quarter of the financial year 2025/26 is an increase of 176% against the Rs.1.52 billion recorded in the previous financial year while the profit attributable to equity holders of the parent is Rs.1.65 billion compared to Rs.1.37 billion in the corresponding period of the previous financial year.

• The profit attributable to equity holders of the parent, excluding City of Dreams Sri Lanka and JKCG, is Rs.2.61 billion in the quarter under review compared to Rs.692 million in the corresponding period of the previous financial year.

• Considering the momentum of the performance of the business, the Group doubled its dividend from Rs.0.05 to Rs.0.10 per share. This reflects the expectation that the current momentum of performance will sustain or further improve over the second half of the financial year. The outlay for the first interim dividend is Rs.1.77 billion, which is an increase compared to Rs.826 million in the previous year.

• City of Dreams Sri Lanka opened its luxury-standard casino, the ultra-high end Nuwa hotel, and the first phase of a premium lifestyle-focused shopping mall. With the integrated resort now fully operational, the project has transitioned out of its capital-investment phase with no further project related cash outflows.

• City of Dreams Sri Lanka achieved close to an EBITDA break-even position for the quarter driven by higher monthly occupancy and conference and banquet revenue contributing to profits despite the significant one-off costs related to official launch of City of Dreams Sri Lanka in August 2025. With the operationalisation of all elements of the integrated resort and based on the booking momentum, we expect to achieve a strong EBITDA uplift, from this base, in the second half of the financial year.

• This positive momentum is expected to accelerate, supported by strong bookings for accommodation and international conferences and events. Cinnamon Life’s unique conference and event venues are attracting significant interest for both local and foreign events. Some international events are now being attracted to Colombo, specifically due to Cinnamon Life’s unparalleled capacity and worldclass facilities that set it apart in the country and region.

• Since its commencement in August 2025, casino operations at City of Dreams Sri Lanka have been steadily ramping up with growing footfall.

• The performance of the West Container Terminal (WCT-1) has significantly exceeded expectations with higher throughput than planned. For the full financial year, we expect to be close to breakeven, in PAT terms, ahead of financial projections, despite being the first year of operations. Considering this momentum, Colombo West International Terminal, the project company of WCT-1, is expected to be a meaningful contributor to Group profits in the ensuing year and beyond.

• JKCG recorded a strong performance during the quarter driven by the number of vehicles handed over to customers. While bookings have been impacted by the ongoing Sri Lanka Customs dispute, JKCG has a very healthy order pipeline with over 3,800 vehicles to be delivered in the ensuing months.

• All the other businesses, with the exception of Transportation, showed growth during the quarter under review. These businesses are expected to show growth through the rest of the year.

• The substantially increased EBITDA contributions across the Group will further strengthen net cash flows. The Group’s net debt to equity at 32% underscores a strong financial position. while we expect the net debt to EBITDA ratio to further improve compared to 31 March 2025 given the higher EBITDA performance.

Summarised below are the key operational and financial highlights of our performance during the quarter under review:

• The Group delivered a strong quarterly performance marked by the contribution from its new investments and businesses as well as a robust contribution across the portfolio. The operationalising of key investments in the first half of the year provides a strong platform to translate to an enhanced profit contribution over the second half and the ensuing financial year.

• Group earnings before interest, tax, depreciation and amortisation (EBITDA) at Rs.18.36 billion in the second quarter of the financial year 2025/26 is a significant increase of 127% against Group EBITDA of Rs.8.09 billion recorded in the corresponding period of the previous financial year.

• Cumulative Group EBITDA for the first half of the financial year 2025/26 at Rs.31.33 billion is an increase of 98% against the previous year. Given the high seasonality in many of our businesses, the second half performance is expected to improve further over the first half. The Group recurring EBITDA for the full financial year 2024/25 was Rs. 45.69 billion.

• Group profit before tax (PBT) at Rs.7.80 billion in the quarter under review is a significant increase of 243% against the Rs.2.27 billion recorded in the second quarter of 2024/25.

• Group profit after tax (PAT) at Rs.4.20 billion in the second quarter of the financial year 2025/26 is an increase of 176% against the Rs.1.52 billion recorded in the previous financial year while the profit attributable to equity holders of the parent is Rs.1.65 billion compared to Rs.1.37 billion in the corresponding period of the previous financial year.

• The profit attributable to equity holders of the parent, excluding City of Dreams Sri Lanka and JKCG, is Rs.2.61 billion in the quarter under review compared to Rs.692 million in the corresponding period of the previous financial year.

• Considering the momentum of the performance of the business, the Group doubled its dividend from Rs.0.05 to Rs.0.10 per share. This reflects the expectation that the current momentum of performance will sustain or further improve over the second half of the financial year. The outlay for the first interim dividend is Rs.1.77 billion, which is an increase compared to Rs.826 million in the previous year.

• City of Dreams Sri Lanka opened its luxury-standard casino, the ultra-high end Nuwa hotel, and the first phase of a premium lifestyle-focused shopping mall. With the integrated resort now fully operational, the project has transitioned out of its capital-investment phase with no further project related cash outflows.

• City of Dreams Sri Lanka achieved close to an EBITDA break-even position for the quarter driven by higher monthly occupancy and conference and banquet revenue contributing to profits despite the significant one-off costs related to official launch of City of Dreams Sri Lanka in August 2025. With the operationalisation of all elements of the integrated resort and based on the booking momentum, we expect to achieve a strong EBITDA uplift, from this base, in the second half of the financial year.

• This positive momentum is expected to accelerate, supported by strong bookings for accommodation and international conferences and events. Cinnamon Life’s unique conference and event venues are attracting significant interest for both local and foreign events. Some international events are now being attracted to Colombo, specifically due to Cinnamon Life’s unparalleled capacity and worldclass facilities that set it apart in the country and region.

• Since its commencement in August 2025, casino operations at City of Dreams Sri Lanka have been steadily ramping up with growing footfall.

• The performance of the West Container Terminal (WCT-1) has significantly exceeded expectations with higher throughput than planned. For the full financial year, we expect to be close to breakeven, in PAT terms, ahead of financial projections, despite being the first year of operations. Considering this momentum, Colombo West International Terminal, the project company of WCT-1, is expected to be a meaningful contributor to Group profits in the ensuing year and beyond.

• JKCG recorded a strong performance during the quarter driven by the number of vehicles handed over to customers. While bookings have been impacted by the ongoing Sri Lanka Customs dispute, JKCG has a very healthy order pipeline with over 3,800 vehicles to be delivered in the ensuing months.

• All the other businesses, with the exception of Transportation, showed growth during the quarter under review. These businesses are expected to show growth through the rest of the year.

• The substantially increased EBITDA contributions across the Group will further strengthen net cash flows. The Group’s net debt to equity at 32% underscores a strong financial position. while we expect the net debt to EBITDA ratio to further improve compared to 31 March 2025 given the higher EBITDA performance.

Latest News

JKH posts strong Q3 EBITDA growth of 68% to Rs.23.76 billion driven by momentum across the portfolio

28 January, 2026

John Keells Holdings PLC Doubles EBITDA to Rs.18.3Bn, Signals Even Stronger Second-Half

04 November, 2025